Cross-border shipping can be a complex endeavor, with numerous customs requirements and regulations...

Leading Causes of Customs Clearance Delays When Importing Into The U.S.

Importing goods into the United States can be a lucrative business venture, but it's important to be aware of potential customs clearance delays that can disrupt your supply chain. There are many steps involved in import, and with tight security measures in place, compliance is more important than ever. Delays happen, but they are usually quite avoidable with some preparation. When importing goods into the United States, several factors can contribute to customs clearance delays. Understanding these common causes can help you navigate the process more effectively.

Customs Inspections

Customs authorities can randomly select shipments for inspection to ensure compliance with regulation, and to detect any prohibited or restricted items. When these inspections occur, it can create delay and issue for the shipment moving through customs with ease. These inspections can be time-consuming, especially if your shipment is chosen for a thorough examination.

While these inspections can be random and unavoidable, to prevent future delays you can ensure you package the shipment in accordance to regulation and that all your paperwork is clear and present. Participating in programs such as the CTPAT can also help benefit you in streamlining customs clearance, as it illustrates an enhanced level of security compliance, and can help speed up the clearance process.

Compliance Issues

Non-compliance with import regulations, such as licensing requirements, product safety standards, and trade restrictions, can result in customs clearance delays. All of the additional documentation for a shipment, is crucial in identifying the products and ensuring they meet security and safety standards. It is crucial to ensure that your goods meet all applicable requirements, to avoid these potential issues.

To stay compliant, you may need to research regulations and requirements ahead of time, or consult a knowledgeable customs broker. Changes in import regulations or trade policies can also catch importers off guard and lead to unexpected delays. It is crucial to stay informed about any updates or changes in regulations that may impact your imports.

Incorrect Classification of Goods

Properly classifying goods using the Harmonized System (HS) code is essential in determining the correct duty rates and any restrictions which may apply. Incorrect classification can lead to delays, as customs authorities may need to reclassify your goods, resulting in additional processing time. Incorrectly classifying goods can also look suspicious to customs, indicating potential fraud motives, so it is important to avoid making these kinds of errors, as they can become costly.

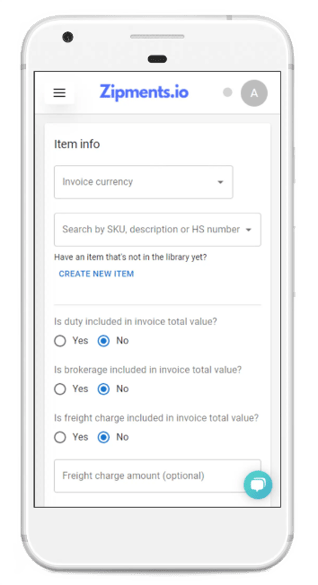

You can consult the CBP's Harmonized Tariff Schedule or seek assistance from a customs broker or trade expert to ensure accurate classification. If you create your customs invoices using Zipments, AI technology can automatically detect your tariff or HS Code for you, saving you time and effort.

Incomplete or Inaccurate Documentation

Insufficient or incorrect documentation is the leading cause of customs delays. Missing or inaccurate information on commercial invoices, packing lists, bills of lading, or customs declarations can trigger additional inspections and require further clarification, which can lead to delays in the clearance process. You will want to avoid errors on your paperwork, and double check before submission. Using technology can help you simplify your documents, with digitally generated tariff classification and error proof document forms.

With Zipments, you can say goodbye to the hassle of accurate documentation.

Our platform leverages the latest technology to ensure error-free paperwork. Whether it's PARS/PAPS tracking, BOL, or customs invoices, you can effortlessly generate all your documents on one user-friendly platform.

Zipments customs invoice forms can save you both time and money, by ensuring accuracy on the first try. Whether you are looking for the Canada Customs Invoice (CCI) or U.S. customs invoices, you can increase efficiency and speed up your import process.

✔️AI Generates Your Tariff For You Automatically

✔️Transmit Invoices Seamlessly

✔️Store Data In Your Personal Library

Increased Security Measures

The United States has strict security measures in place to protect the nation and its economy. During periods of heightened security or when there are specific security concerns, customs authorities may implement stricter inspection protocols. If you are shipping from certain countries which do not have strong ties to the U.S., you may face additional checks. These security measures can lead to delays as shipments undergo more thorough scrutiny.

Peak Seasons and High Import Volumes

During peak seasons or when there is a high volume of imports, customs clearance delays are more likely to occur, because there is an overwhelming amount of shipments which need to be cleared. Increased workload and limited resources can slow down the clearance process, especially if customs authorities are dealing with a significant influx of shipments. It is beneficial to plan ahead and avoid shipping last minute during known peak seasons, such as November through January. Communicate with your shipping agent or customs broker to ensure they are aware of your shipment and can allocate resources accordingly.

Navigating customs clearance when importing goods into the United States requires careful attention to detail and proactive measures. By ensuring complete and accurate documentation, correctly classifying your goods, staying compliant with regulations, and staying informed about any changes, you can minimize customs clearance delays. Working with experienced customs brokers and maintaining open communication with your shipping partners can also contribute to a smoother import process. Importing is complex, but there are ways to stay ahead of the game.