Global trade and e-commerce are booming, creating new opportunities for small, independent...

Understanding Customs: How To Pay Your Duties

Accessing new sales markets has its challenges, and international trade is a whole new world of costs and hassles. Duties are one of the most common costs associated with international trade. Getting your products to Canada and the United States, for instance, is only half of the equation. You usually must pay duties, costs and taxes on whatever you send across borders. Knowing how duty fees work and how to pay them, can help save money, time and hassle.

.jpg?width=1920&height=1080&name=Red%20Blue%20Neon%20Technology%20Video%20(5).jpg)

What Is Customs Duty?

A customs duty is the tax or tariff that is imposed on goods when they move across international borders. Their purpose is to protect each country’s economy and the country itself, by monitoring and controlling the flow of goods in and out of the country. Each item is classified differently and has a specific duty rate, which is why the tariff or HS/HTS code is important. The duty rate is a percentage, and it is calculated in relation to the total purchased value of the goods and the classification. Duty fees vary based on a number of factors, including:

- country of origin

- declared value

- destination country’s rates/regulations

- product category

- any free trade agreements in place

Who Pays Duties and Taxes?

In most cases, the shipper or receiver will be responsible for paying duties on a shipment. However, carriers transport goods across borders, so they are responsible for collecting duties and taxes, as well. They can collect the fees from either the seller or buyer, depending on the terms agreed upon. Carriers can also charge brokerage or disbursement fees for their services in this instance. Customs will usually notify you or the courier regarding the duty a shipment incurs and the due date for payment.

There are also two common terms to get familiar with if you import or export internationally, and that's DDP and DDU. If the shipper is the one paying the fees then the shipment is known as DDP (Delivery Duty Paid), which means the receiver does not have to pay duties and taxes. However, if the shipment is sent as DDU (Delivery Duty Unpaid), then the receiver is on the hook for the payment.

An essential document when it comes to calculating your duty fees is your customs invoice. Any errors on your invoice can lead to delays and unexpected additional fees.

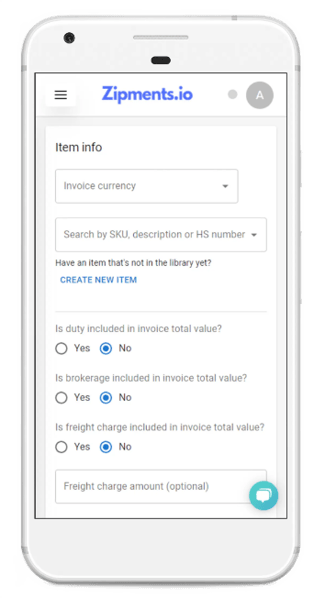

You can save time, money and avoid unnecessary stress in customs by using Zipments’ technology to create your customs invoices. Get your goods classified right the first time, with the Zipments customs invoice forms.

✔️AI Technology Detects Your Tariff Code Automatically

✔️Generate Your Bill of Lading

✔️Transmit Easily Between Broker, Carrier or Importer

✔️Updates From The Broker Are Automatically Sent To You

Generate your Canada Customs Invoice (CCI) or US Invoice For Free.

Paying Customs Duties To CBP

Customs and Border Protection (CBP) in the US is in charge of collecting duties. If you are shipping into the United States, and the value of the goods imported is above $800 USD, then you would be subject to paying duties on your shipment. Any shipment above $2500 USD requires a formal entry as well, while shipments below this amount but above the 800 USD amount require only a simplified clearance. You can also request a shipping invoice before the delivery if you let your courier or CBP know beforehand, so that you can pay the charges before goods arrive at customs.

All duties will need to be paid in USD currency. To pay your duties in the US you can prepare a money order or cheque and mail it to the CBP. You can also visit CBP outlet locations to make a payment, but they will only accept cash, check or money order, and credit card (at certain ports of entry or locations only). Another option you may have, to pay your duties and fees, is to use the ACH system (Automated Clearinghouse System), which is an electronic payment solution which requires an ACH account.

Paying Customs Duties To CBSA

Canada Border Services Agency (CBSA) will collect duties and taxes on behalf of the government, but who pays these duties can vary. Usually the importer or receiver will be responsible for the payment. If you are using a broker, then the money is paid to the broker, who forwards the payment to the CBSA. All duties will need to be paid in CAD currency.

CBSA encourages payments to be submitted electronically. You can use your CARM client portal online for payment of duties and taxes, if you have Release Prior to Payment (RPP) privileges. If you do not have RPP privileges, then you can pay at the time of release at the port of entry using credit card or interac online. You can use your Visa, MasterCard, American Express or debit card. Sometime payments can be made by check, but the CBSA does not accept cash, wire transfers or traveler’s checks at this time. You can find a more comprehensive outline of CBSA rules on their website.

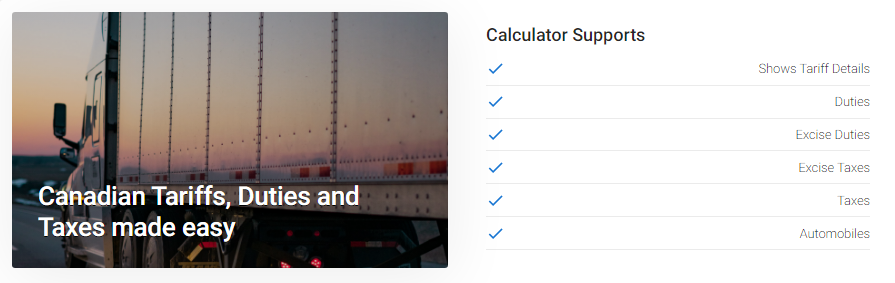

Don't be caught paying too much! You can use Zipments Duty and Tax Calculator to get an accurate estimate of costs on your shipment, and make sure you're not getting overcharged. Simply input your product information and you'll receive an accurate estimate of fees.

Duties on imports can be rather complicated. We know that clearing customs can be a bag of unexpected fees and delays. That's why we provide a secure and reliable customs clearance technology to help you minimize the risk of paying unexpected fees on your global shipping. Zipments makes it easy to import to the US and Canada. We simplify your customs clearance with our easy to access forms and technology, to ensure you do not have to pay any unexpected fees, so you can trade with confidence. You can focus on growing your business instead of worrying about customs.

-1.png?height=200&name=Brown%20Simple%20Tips%20Shoot%20Blog%20Banner%20(8)-1.png)

.jpg?height=200&name=Food%20Presentation%20(1).jpg)

.png?height=200&name=Red%20Blue%20Neon%20Technology%20Video%20(5).png)