The smooth running of a business is as important as the quality and taste of the product. For those...

The 7 Steps Involved In Submitting Documents To Your Customs Broker

The import process can be a confusing one, and a customs broker can be an excellent resource. Brokers can help with customs clearance and document submission, among a number of other import procedures. A customs broker is an essential part of your import process, but communicating with them is not always straight forward. If you need to submit documents to a broker for customs clearance, then there are a few key steps you will want to get familiar with.

-1.jpg?width=1920&height=1080&name=Blue%20Illustrated%20Dots%20Hosting%20Provider%20Presentation%20(13)-1.jpg)

Don't be worried if you don't have a lot of experience with customs procedures. Customs can be daunting, but a customs broker can make the process easier for you. They know what forms are necessary for your product, and how to navigate the system with ease. Brokers are useful in many ways, including saving you time and money by providing advice on import documentation and making sure your items are cleared through customs. When you are working on customs clearance with with a customs broker, there are a few key steps you will take to submit your documents.

Step 1 - Identify The Customs Broker You Are Using

You will need to gather the updated and accurate contact information for the broker responsible for your shipment, including any after-hours contact information. You need to ensure you are submitting documents to the right customs broker, so check to make sure you are on their website or in possession of the correct numbers to contact.

Can't get in touch with your broker? No problem. Zipments Customs Brokers Directory is here to help you find the accurate information for any broker, and get in touch with them directly.

With Zipments you have access to all necessary information, including:

✔️Broker Website

✔️Address

✔️Phone/Email/Fax number

✔️Customs Brokers Agent Used at Each Port

✔️After Hours contact information

Step 2 - Assign Power of Attorney

An important step to take before importing your product is to give your customs broker a power of attorney (POA), which will allow your broker to do much of the work on your behalf. While there is a lot of legal terminology which can become overwhelming; the document essentially allows a broker to transact on your behalf with customs. In giving your customs broker POA, you then grant them the ability to act for you in matters related to importing and exporting your goods. In order for a broker to be able to submit documents on your behalf, they need to be able to have POA.

Step 3 - Match Your Shipment To The Documents

You will need to double check that the loaded shipment matches the paperwork accompanying it, as well as the documents you are submitting for customs clearance. A lot of the paperwork for a shipment is submitted through a manifest portal for pre-arrival review and processing, so your documentation needs to be accurate and relevant to your specific shipment. Any inconsistencies between documents and the cargo itself may lead to customs delays.

Remember that your PARS/PAPS barcode also needs to match what is sent in via eManifest. As well, the Cargo Control Number should match what you provide to the customs broker, and all descriptions or counts should be included as well. If you send a broker inaccurate documents or information, it will delay their ability to clear the goods on time.

Step 4 - Gather All Relevant Paperwork

It is important to check that you have all the required paperwork for your shipment, which includes any additional certificates or licenses from other government agencies, if needed. Any missing information or document will result in delays in processing. Some of the paperwork needed for the shipment includes:

- Bill of Lading

- Customs Invoice

- PARS/PAPS Labels

- Packing List

- Certificate of Origin

- Additional Documents (per country), Certificates or Licenses

Importers can estimate the taxes and duties on their shipment by understanding the tariff classification codes for their products. Your customs invoice will require the tariff or HS codes for this purpose, so that customs can assess the amount owed. The tariff classification also informs of any requirements or restrictions which may apply to goods. Customs brokers do calculate duties and fees, but they must have accurate tariff classification codes to accurately calculate duty taxes and fees on an importer’s behalf.

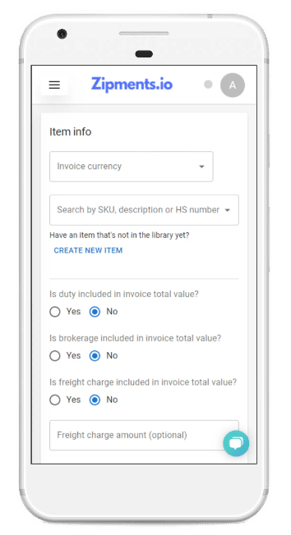

Completing your customs invoice is easier when you use the right technology.

Zipments custom invoices can be generated in just minutes without the need for any manual research. Zipments integrates AI technology to generate accurate and up to date tariff codes for your products. You can be sure of accurate invoice processing, so you can focus on your business instead of paperwork.

✔️Transmit easily between broker, carrier or importer

✔️Generate your Bill of Lading

✔️Updates from the broker are automatically sent to you

You never worry about the wrong tariff code again.

Step 5 - Ready The Documents For Submission

It is important to know how to compile the documents needed. All paperwork submitted should be in PDF format, for ease of access. Your PARS or PAPS sticker will need to be attached to the customs invoice. There should be one label per each pickup or drop off used, so you will need a separate barcode for each shipment. Under the PARS or PAPS you will need to write the port of crossing and ETA (estimated time of arrival), as closely as you can. Contact information should also be included, in case the customs broker needs to verify any information with you or get any additional information.

Step 6 - Submit Your Documents

All of the paperwork included should be submitted to the addresses of the contact information you have for the broker. Carriers need to report goods entering the country through the ACE (US) or ACI (Canada) systems, as well as submitting documents to the broker. Once the broker has the relevant paperwork, they will submit a release request for the shipment. All documents should be submitted minimum one hour prior to arrival at the port.

Step 7 - Track Status

You can track your PARS and PAPS to see if a shipment has been cleared to cross, before the driver even reaches the border. You should make sure that the shipment has been accepted at least one hour before arrival at the port, so that any issues can be fixed if a problem comes up. You can monitor for any issues using your tracker, which is accessible to importers and truckers, for easier access and streamlined communication. All duties or taxes will need to be paid for, before the cargo is released at the border, unless other pre-arranged steps were taken or you have bonded goods.

You can track your PARS and PAPS status in real-time using Zipments. We provide easy to navigate access that makes it easy to see where your shipments are at all times, so you can stay up-to-date on the progress of your customs clearance. Never miss an update with our easy to follow process.

✔️Purchase PARS/PAPS Labels, Shipped Within 1 Business Day

✔️Set Tags, Make Notes, Share PARS/PAPS Status Updates

✔️Track Multiple PARS/PAPS at Once, For Any Broker

As an importer or carrier, it's important to know what you'll need to do in advance of shipping goods out of the country. Customs brokers can be a valuable resource, but only if used correctly. In today's world, with so many different forms of documentation and documents to follow, nothing should be taken lightly. Take control of your customs clearance by using one platform: Zipments. You can simplify your customs clearance with just one platform for all your paperwork, tracking and compliance needs, so you can focus on growing your business. .

-1.jpg?height=200&name=Blue%20Illustrated%20Dots%20Hosting%20Provider%20Presentation%20(10)-1.jpg)

-1.jpg?height=200&name=Food%20Presentation%20(2)-1.jpg)

.jpg?height=200&name=Grey%20Modern%20Professional%20Business%20Project%20Presentation%20(4).jpg)