Customs invoices are a vital component of international shipping, acting as a cornerstone document...

Customs Invoice Checklist For a Smooth Clearance

Customs processes can be complicated and time consuming. However, knowing how to minimize delay by ensuring your paperwork is in order, is one of the most important steps in your shipping journey. You can gain confidence in international shipping, by mastering the customs process. Understanding the information required on your documents, as well as common errors to avoid, can make a big difference in the time it takes to move goods through customs.

One of your most important documents in international shipping will be the customs invoice. Often small mistakes are made which can amount to timely delays, and even potential fees for shippers. In order to ensure a smooth customs clearance, there are a few key items that need to be included on your invoice, as well as double-checked for accuracy.

-1.jpg?width=1920&height=1080&name=Food%20Presentation%20(3)-1.jpg)

The customs invoice is to be filled out by the importer, exporter or any associated agents in the process. It is important to use the currency of the country you are importing the goods into, so if they are coming into the US for example, then the amounts should be in USD. Your customs invoice is important for many reasons, but the primary purpose is to ensure a proper calculation of your duties and taxes. The information on your invoice provides customs officials with enough data to assess accurate duty and taxes.

How Are Duties Assessed?

Your customs invoice is an important document that can answer a few key questions for customs, which allows officials to assess the correct duty amount. Different countries do have their own methods for assessing for duties and taxes, but usually they consider the same key factors in their review. There are several main factors which come into consideration when customs assesses for duties and taxes.

- Description of Goods

- Country of Origin

- Value of Products

- HS Code

- FTA Agreements In Place (Free Trade Agreements)

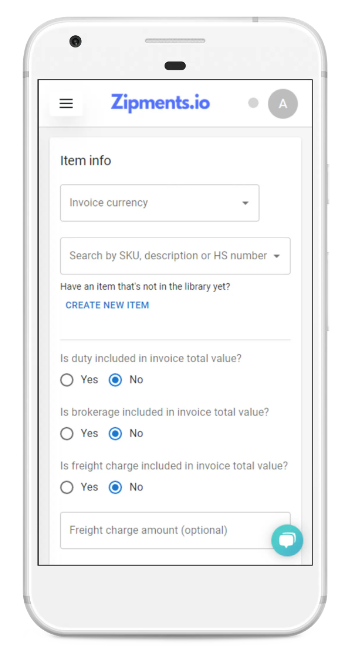

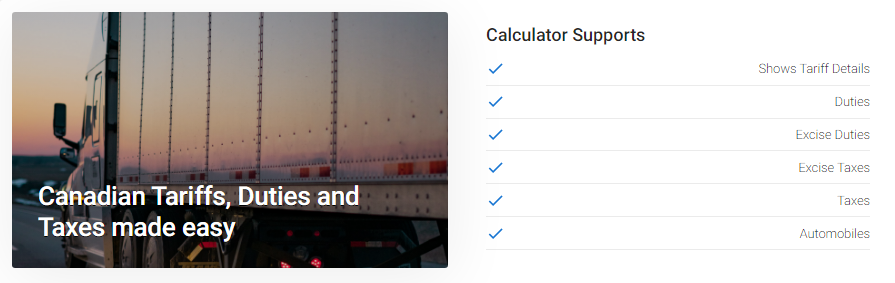

If you are importing to Canada, you can get an accurate estimate of your duties and taxes using the Zipments Duty and Taxes Calculator. Simply input your information and get an estimate of how much you may need to pay. You can search items by HS Code or description of the item, for easy navigation.

Customs Invoice Checklist

Customs invoices hold more detail than a regular commercial invoice, so it is important not to miss few key items on your invoice. While the basics such as invoice number, date and quantity are usually present on these invoices, it may be easy to miss a step or fill them out incorrectly, which can lead to delays. In order to ensure a smooth transit and customs clearance, there are a few essential pieces to be included on your next customs invoice.

Detailed Description of Goods

It is essential to ensure your description of goods contains enough detail to be able to identify and explain to customs what the goods in your shipment are, and who will be using the goods. Rather than describing an item as a “book” only, for instance, you will want to add the genre as well. If your shipment contains shoes, you specify what type of shoe it is, the size, and the materials it is made out of, such as rubber or leather.

Always remember that quantity, details of the item and intended use of the item should be part of your detailed description. You will need to avoid vague descriptions, so that anyone who has not looked inside the shipment will be able to know what it contains, through the description. Descriptions should use plain language, and be precise.

HS Codes

Your items will need to be correctly classified, in order for duties and taxes to be determined by customs. Your HS Code or tariff Is one of the most important items on your invoice, as it helps determine whether goods are admissible and which category they fall into. Incorrect classifications can even be considered as fraudulent activity to avoid paying duties, so it is important not to make errors on your documentation.

To generate your up to date code you usually would need to research your item and find the right code. However, technology has simplified the process for you, so that you avoid any classification errors. When you create your customs invoice using Zipments, AI technology generates the tariff for you, so that you can speed up your process and avoid mistakes on your invoice.

Zipments customs invoice forms are CBP and CBSA approved, and contain and easy to fill out template. You can ensure a seamless transition into a digitized age.

✅Transmit easily between broker, carrier or importer

✅Generate your Bill of Lading

✅Record item library and seamless record keeping

✅Updates from the broker are automatically sent to you

Value

Your customs invoice should include both the total value or price as well as unit price for the goods in your shipment. However, when you are listing the value on your invoice, it is important to list the price that the buyer is paying for the goods in the transaction, and not the amount they will be sold for.

Country of Origin

In order for goods to be assessed by customs for duties and taxes, as well as their admissibility, it is essential that their country of origin is identified correctly. The country of origin is where the goods were manufactured, grown or produced. They are not always the same location as where the goods are shipped from, so it is important to know the difference. In international trade, certain countries are exempt from specific taxes or duties to some degree, due to free trade agreements in place, so your country of origin will be a beneficial piece of information to accompany a shipment.

Addresses

You will need to include the names and contact information for the shipper and consignee. The consignee is the buyer or importer to whom the goods are being sent to. The consignor or exporter is the one selling and exporting the goods listed on the invoice.

Incoterms

Often invoices will contain incoterms or terms of sale that are agreed upon by the buyer and seller, and these outline who will pay for different aspects of the shipping, transport or customs clearance process for the good. The terms ensure that costs are decided upon and taken care of, so that goods can move forward.

Understanding customs processes is essential for shipping, but with technology you can make the process easier. Take it a step further with Zipments, your trusted platform to streamline documentation and ensure a seamless customs clearance. When it comes to international shipping, control and visibility are key for success. By digitizing your process through a single platform, you gain complete control and visibility, leading to a smooth and successful shipping journey.

.png?height=200&name=Blue%20White%20Modern%20Business%20Blog%20Banner%20(3).png)

-2.png?height=200&name=Brown%20Simple%20Tips%20Shoot%20Blog%20Banner%20(2)-2.png)

.jpg?height=200&name=Food%20Presentation%20(4).jpg)