With e-commerce, it's become easy to ship from anywhere. Businesses are always looking to expand...

How To Fill Out a Canada Customs Invoice - Free

The best way to grow your business is to expand into your second market. For businesses of any size, expanding your market into a country like Canada can generate more profit and expand your customer base significantly. There is a vast new consumer base to uncover! However, importing into Canada does require some research and careful planning.

Invoices are one necessary part of shipping goods. A customs invoice ensure that all information is true, accurate and helps customs assess a shipment. When importing goods into Canada, it is essential to have the Canada Customs Invoice (CCI). Non-compliance can result in challenges such as delays and additional fees. If you plan on shipping into Canada, then it is important to understand what the Canada Customs Invoice is, why it’s different from a standard commercial invoice, and how to complete yours correctly.

.jpg?width=1920&height=1080&name=Food%20Presentation%20(4).jpg)

Canada Customs Invoice (CCI) Form vs. a Commercial Invoice

A Canada Customs Invoice form (CCI) is one of the most important documents when shipping or importing into Canada, and you will need it in order to clear customs. The CCI contains more information than the standard commercial invoice, so it is necessary to complete the right invoice and have enough information, when importing into Canada. The CCI is a document containing detailed information about the goods, which is then used to assess duties and taxes on the shipment. It is used for shipments valued at over 2500 CAD.

You will need to make sure you are in compliance with CBSA regulations before importing any goods into Canada, as certain goods require added permits or may even be prohibited. Certain goods such as health products or food are subject to additional requirements and permits, so it is important to understand the regulations pertaining to your product Each shipment is going to require its own unique invoice, as well.

How Do I Fill Out a Canada Customs Invoice? What Does a Customs Invoice Look Like?

Canada Border Services Agency (CBSA) requires certain information to be present on an invoice, so your customs invoice will need to match a CBSA approved customs invoice template, or contain all the information required on the CCI in order to be accepted. Some mandatory information which your CCI needs to contain includes:

- Total Value

- Quantity

- Weight

- Unit Price

- Country of Origin

- Importer of Record/Purchaser

- Currency of Sale

- Date of Shipment

When preparing your customs clearance documents, you will need to plan for your Canada Customs Invoice. In addition to your BOL and cargo control document, the customs invoice is integral in the customs clearance process. One copy of your CCI should be attached to your Bill of Lading and one to your shipment, so it is always wise to print at least 3 copies

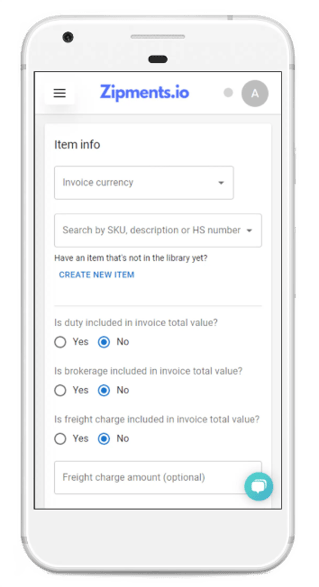

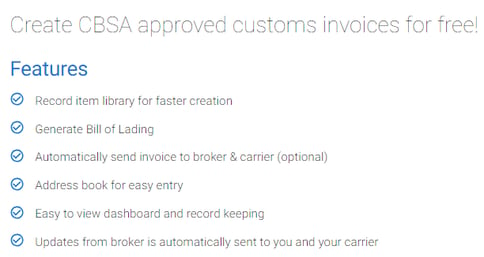

The easiest way to avoid errors on your customs invoice is to use the right provider in filling out your form. With Zipments, you can complete your Canada Customs Invoice within minutes, with automatically generated form fields you can fill out, so you don’t miss any details. The latest AI technology also generates tariff or HS codes for you automatically, so you don’t have to worry about classification errors.

Your customs invoice can be shared between you and the carrier or customs broker, on our streamlined and easy to use platform. Zipments ensures that all your information is stored safely, and you can follow each form field step by step, so that you do not miss any details. To get started click the button below!

Who Can Fill Out a Customs Invoice?

The CCI or customs invoice can be completed by an importer, exporter or relevant agents who have knowledge of the required information. The importer of record is responsible for the documentation submitted being correct and in accordance to regulations, so it is important to avoid any errors to begin with.

If you forget to fill out a Canada Customs Invoice, then your goods may be held at the border and release will be delayed, along with other costly added fees you may need to pay.

Duties and Taxes For Canadian Imports

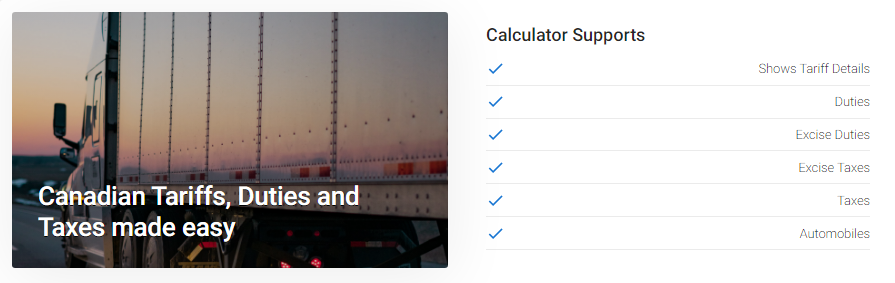

When importing goods into foreign countries, it is important to properly classify your items on your invoice, for the purpose of duty and tax calculation. Any items or goods entering Canada could be subject to duties and taxes. When importing into Canada, goods are subject to not only GST (Goods and Services Tax), but also HST (Harmonized Tax) or PST (Provincial Sales Tax), for provinces which have not implemented HST yet.

The value of goods in CAD currency, which is found on the customs invoice is very important, as it is the main data point through which duties and taxes are assessed on a specific shipment. These duties and taxes are in place to generate revenue for the local industry and help facilitate safe trade internationally. Some ways that duties and taxes are calculated includes:

- Total Value

- Trade Agreements In Place Between The Countries

- The Type of Use of the Product

- Country of Origin

- HS Codes

The HS code helps classify products, which can then assess the duty or tax owed on the shipment. Getting the wrong tariff or HS Code can lead to delays and additional costly penalties, so it is important to stay up to date when filling out paperwork. When importing into Canada, you can use the Zipments Duty and Taxes Calculator, to determine an accurate estimate of the price you may be paying at customs.

How To Avoid Errors On a Customs Invoice

Some common mistakes on the Canada Customs Invoice are most likely related to incorrect information or missing information on the form. The country of origin is often found to contain errors, as the country of origin is actually where the goods were manufactured, produced or grown. It is important to remember that the country where you ship goods from is not the country of origin, unless the goods were also manufactured or produced there as well.

You need to ensure that you are filling out every part of your form correctly. Include full names, and detailed description of goods in the form fields. Getting the wrong tariff or HS code can lead to classification issues which can become costly for you, so it is important to have the right HS code. AI technology and Zipments customs invoice forms have a solution: automatic HS code generation.

To avoid errors, automating your customs invoice using a reliable customs clearance provider is key.

If you ship internationally, it's important to be prepared for the unexpected. Zipments can help you prepare for import and export without the hassle of tedious paperwork. Zipments AI-enabled customs invoice form template is an efficient way to ensure your documents are accurate and complete. It's now easy to create and complete your customs invoice without the hassle of going through a complex classification process. You can start your international expansion today.

-1.jpg?height=200&name=Blue%20Illustrated%20Dots%20Hosting%20Provider%20Presentation%20(9)-1.jpg)

.jpg?height=200&name=White%20Minimalist%20Aesthetic%20Magazine%20Photography%20Portfolio%20Presentation%20169%20(17).jpg)

-1.jpg?height=200&name=Food%20Presentation%20(2)-1.jpg)