The seamless exchange of goods and services across borders has become the lifeblood of nations;...

Documents You Cannot Forget When Shipping Or Exporting From Canada

With e-commerce, it's become easy to ship from anywhere. Businesses are always looking to expand their market globally, but it’s important to know how to do this safely and efficiently. Shipping is an important part of business strategy. For shippers from Canada, international and cross-border transactions have become a common and easy way to expand business. However, it is important to be well prepared for any shipment, and avoid missing key documents that may cause delays or costly repercussions for your business.

-1.jpg?width=1920&height=1080&name=Blue%20Illustrated%20Dots%20Hosting%20Provider%20Presentation%20(9)-1.jpg)

It can become costly to deal with the hassle of fixing paperwork errors, especially when your business relies on shipping products internationally. It is important to understand regulations and rules when it comes to shipping, and avoid common document errors that can lead to delays or added fees. For Canadian exporters, international trade can be made easy, when a few essential documents are accounted for. Here is the breakdown of some of the essential documents you will not want to forget or make mistakes with, when exporting from Canada.

Certificate of Origin

Having the Certificate of Origin (CO) is essential in shipping internationally, and ensuring that you are not paying unnecessary fees at customs or breaking any international laws. The CO document depends on the country goods are heading into, meaning there is no universal format that fits all. A common mistake in shipping is made by placing just the country a product ships from as the "country of origin" on documents, when sometimes this is not the case. In having this document, you can show that the product complies with the rules of origin.

The country of origin of a product affects the fees and duties paid at customs, because the origin is used to determine any trade agreements in place, fees or restrictions which may apply. It is also an essential piece of information because tax authorities and customs officials use this information to prevent fraudulent activities such as tax evasion through misrepresenting origin. Getting this information correct is essential for both a timely, and cost-effective clearance. There are two types of Certificates of Origin you should be familiar with:

- Preferential (PCO): Based on bilateral or multi-lateral Free Trade Agreements (FTAs). This is usually where products which are free of tariff charges, allowing buyer to pay less customs duty thanks to trade agreements in place. If the destination country has an FTA with your country, then you can use this CO.

- Non-Preferential: When there are no Free Trade Agreements (FTAs) in place, then this CO is used. This certificate is not subject to preferential tariff trade agreements in place, and thus has to comply with non-preferential rules of origin, which includes tariff charges or customs duties.

Canada and the United States share a mutually beneficial trade relationship, with the US being Canada’s largest export market. However, for Canada, there are a few major trade agreements in place currently.

- Canada-Unites States-Mexico Agreement (CUSMA)

- Canada-EU Comprehensive Economic and Trade Agreement (CETA)

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

Customs Invoice

One of the most important documents in international shipping is the customs invoice. Usually the exporter or seller prepares the document. The invoice serves as a receipt and proof of purchase, and helps customs in determining taxes, duties or fees on the shipment. The customs invoice needs to contain more key information about a shipment than a standard commercial invoice would, including:

- Contact Information For Sender and Receiver

- Transaction Details

- Detailed Description of Products

- Country of Origin

- Tariff or HS Codes

- Terms of Sale or Incoterms

Importers and exporters should note that Canada requires a Canada Customs Invoice (CCI) for exports to Canada, and other formats will not be accepted, because the CCI contains a bit more information than the standard commercial invoice. You will use a U.S. Customs Invoice form to import into the United States, for instance. You will need to print at least 3 copies of your customs invoice, as things may get lost in transit and customs officials may remove a copy before the shipment moves forward.

A major reason customs invoices are important, is because the total value, type of product and country of origin specified on the invoice helps determine tariff rates, duties and any other fees. The total customs clearance costs of a shipment will be determined using this document, so it is essential to get it right the first time.

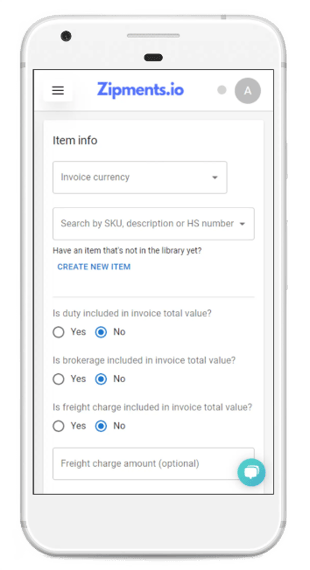

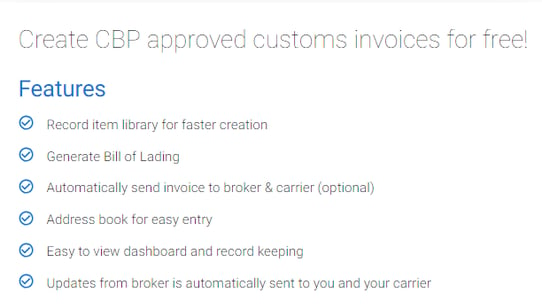

Looking for an efficient and easy way to get your customs invoices done? Try Zipments. With the Zipments Customs Invoice Forms, AI technology automatically generates the HS codes for your shipments, ensuring accuracy and saving you time. Now you can avoid costly mistakes and penalties, while growing your business.

Zipments Customs Invoice Forms are a simple, yet powerful tool that will help you save money and time while getting accurate information on your customs paperwork. The easy to fill out form fields ensure that you get all the necessary information required for customs processing.

Invoices can be transmitted to carrier and customs broker, ensuring seamless communication and visibility.

Bill of Lading

The Bill of Lading (BOL) is a mandatory document in customs clearance, as it includes important information about the shipment, and is required at pickup. The BOL is issued by the transport company or carrier to the shipper, outlining the key information about the goods. The BOL includes item count, weight, package contents, product detail, price and destination, as part of the information.

The Bill of Lading serves as a receipt of the shipment, and ensures more security in transport. The BOL can also document any special requirements for the shipping of a specific product, to ensure more security for the product.

When you use Zipments to complete your Customs Invoice Forms, you can automatically generate the Bill of Lading as well!

CERS Filing

An essential part of the export process from Canada will be your CERS filing, which many exporters may accidentally miss. If you are exporting to anywhere other than the US, then you will need to file your CERS. CERS (Canadian Export Reporting System) is a streamlined way for exporters to file their information, and it is mandatory for any export leaving Canada. The CERS filing informs CBSA of the export leaving the country and allows CBSA to track exports and enforce regulations, such as permits.

The CERS has been in effect since 2020, and has replaced the old CAED system. It is fully electronic and failure to submit this filing will result in hefty fines and other penalties. Goods valued over 2000 CAD, or regulated/prohibited goods will require a CERS filing, as well as goods heading anywhere other than the USA. CERS filing can be complex if you don’t know what you are doing, so you will want to get it right the first time.

Read more: "The CERS Filing Can Make or Break Your Canadian Export Process: What You Need To Know"

Are you filing or setting up your CERS? Zipments can help you get started with our easy process. From filling out forms to setting up your account, we’ll make sure your application is accurate and hassle-free. If you don’t want to waste time or money, get the help you need from our team of industry experts. We can help you set up your CERS and walk you through the process, with competitive affordable prices and short wait times. To learn more contact support@zipments.io or reach out to directly to our representative elvis@zipments.io.

Customs clearance can easily be complicated, and you can lose valuable time with unnecessary delays. Avoid missing the important documents. by making sure that you are using a reliable platform for your customs needs. Let Zipments ease your customs clearance process, through easy to fill out customs forms, streamlined process and dedicated support team. Our team of industry experts has created technology to simplify customs clearance, and ensure a smooth experience, so that you can get back to growing your business.

.png?height=200&name=Red%20Blue%20Neon%20Technology%20Video%20(4).png)

.jpg?height=200&name=Food%20Presentation%20(4).jpg)

.jpg?height=200&name=Brown%20Minimalist%20Company%20Presentation%20(2).jpg)