Global shipping is a key part of the global economy. Customs clearance, however, can present...

The 7 Document Errors Which Cause Customs Delays

Shipping internationally can be tricky. International shipments have to go through customs, which can become a complex process. There is a lot lot of information that has to accompany commercial goods, in order for customs to assess and review the shipment. The most likely cause of customs delay for most shippers will be documentation issues. There is a lot to keep track of, and many regulations to adhere to. Customs delays are a pain, but understanding the most common paperwork errors and how to avoid them will help keep your business moving forward.

.jpg?width=1920&height=1080&name=Brown%20Minimalist%20Company%20Presentation%20(2).jpg)

Error #1: Incorrect Country of Origin

One of the most important pieces of information your documents will need to include is the country of origin, which is not to be confused with where the goods are shipped from, as these are sometimes different locations. The country of origin is important because it informs customs of where the product was manufactured, grown or created. Quotas, trade agreements, anti dumping measures and countervailing duties are all policies which can be applied to specific products based on their country of origin, so it is important to include the correct data on your documents.

When importing to Canada or the US, the country of origin helps determine which goods are entitled to specific free trade agreements, and sometimes this can actually help reduce duties paid, based on the agreements in place. Getting an incorrect country of origin on your documents can result in delays, fines, seizure and increased chances of audits, so it is a piece of information you want to get right.

Error #2: Incomplete Documents

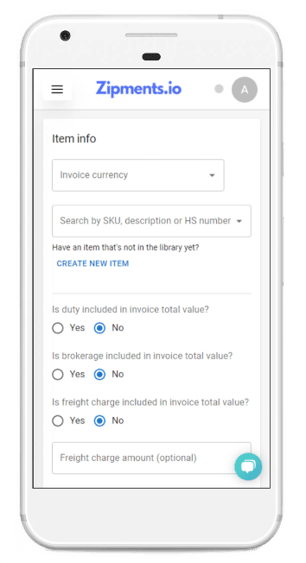

An easy error to make is the failure to fully complete a document or fill out every field on a customs document, which can also lead to delays and even fines. It is important to fill out the correct form templates for all your documents, especially the customs invoice and bill of lading. You should research ahead of time which documents are needed for your shipment, and then use the right customs clearance partner, such as Zipments, to help you gather and complete the documents with accuracy.

You cannot miss the required permits or licenses as part of your paperwork, because it will lead to further delay at customs. Certain goods may require extra paperwork and certificates or permits, so you will need to comply with regulation and ensure your documentation is fully complete. Shipments will be held until all documents are obtained and correct. Normally customs brokers would help fix errors with documentation, but a lot of the time in modern day, this responsibility is also pushed back toward the shipper, which make accuracy even more important.

Addresses can also sometimes be left incomplete or missing, which can create issues, because all parties need to be clearly identified and communicated with, especially in the international transport process. Customs needs to know who is sending the goods and who is the buyer or purchaser, while carriers need to know where the goods are going.

Error #3: Ineligible Documents

Paperwork has to be easy to read and understand by whoever is checking your documentation, or you may encounter delays. Your documents also need to match, in terms of information, so do know that you cannot have a mismatch between your paperwork. This means that your customs invoice information should match the bill of lading data, and so forth. Nowadays we are shifting toward technology more. Errors can be more easily avoided, if you use technology to complete your forms online, so they are easy to read and understand.

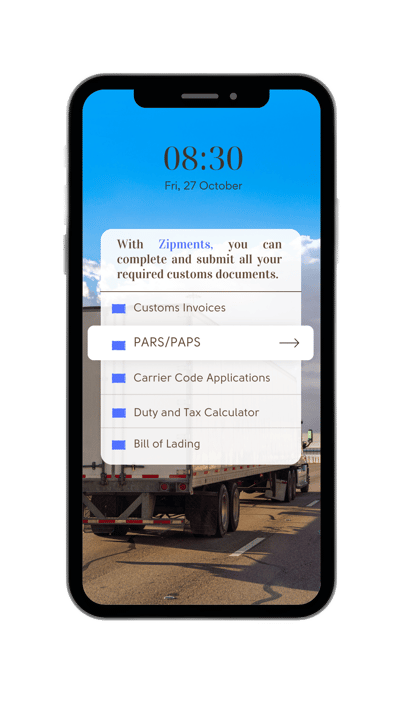

When you work with a customs clearance partner like Zipments, you can ensure that all your paperwork will be completed using the latest technology, which saves time and reduces errors. Zipments provides all of the key customs forms needed for shipments to clear customs with ease, including PARS and PAPS labels and real-time tracking.

Error #4: Missing Documents

You want to prepare your paperwork ahead of time, and ensure that you are not missing any required documents for your shipment. Clearance paperwork is not the same globally, so you will want to take careful consideration of where you are shipping or importing to - understanding the requirements for your country. Two vital documents for most shipments are the Bill of Lading and your Customs Invoice, which includes critical details about the shipment and helps assess duties, fees and taxes. The invoice helps determine whether the goods can move in or out of a country, and if there are any added restrictions on the shipment. Your customs invoice needs to contain key information, including:

- HS Code or Tariff

- Buyer and Seller Information

- Product Details/Description

- Country of Origin

- Terms of Sale or Incoterms

Error #5: Inaccurate Product Description

An important mistake to avoid at customs is inaccurate descriptions of the product, as well as inconsistencies in your description. Your documents such as the customs invoice needs a detailed description of the goods, because it allows brokers to easily classify your goods and process your shipment, and customs can understand what is in your shipment. Some goods have restrictions or are prohibited, so the description not only helps assess for duties, but also helps determine eligibility of entry into the country. Customs is more likely to inspect your shipment in greater detail if the product description is not correct or detailed enough.

A good description contains precise and detailed information about the product. You should consider what the goods are, what materials they are made of and their purpose, as part of your description. Plain language should be used, so that it can be understood by anybody who may read it.

Error #6: Inaccurate Weight or Quantity

Part of your documentation will need to include information on the product inside the shipment, because this helps determine the total value of the goods, and helps simplify the shipping process. If you miscalculate quantity for instance, then this will affect your goods declared value and thus lead to customs errors. Your customs invoice should include the right value and weight information, as it can tie the goods to the correct documents. The quantity and weight of goods helps determine fees on the shipment, as well as helping carriers plan their transport trips and determine shipping costs, so it has to be accurate.

Error #7: Wrong Tariff Code

Your tariff or HS code is one of the most important pieces of data included on your customs paperwork, as it informs customs of what is being brought into the country and helps in calculating taxes, fees and duties on the shipment. The tariff also helps ensure free trade agreements are followed, and makes sure that goods entering a country are allowed to come in. Incorrectly filling out your tariff code or missing it altogether can result in several issues, including:

- Delays In Customs Clearance

- Overpayment of Duties – Miscalculations

- Red Flag For Customs – Can Lead to Audits

- Missing The Chance To Apply a Free Trade Agreement and Reap Benefits

Identifying the correct tariff code can be a difficult task, as it involves research. Sometimes products can fall within multiple categories at once, which makes finding the correct code difficult. A lot of tariff classification is open to interpretation, based on the search, which can lead to errors. It is important to carefully classify your goods, as this will make a big difference in the costs you may need to pay to clear customs.

Customs Invoices and Tariffs

Zipments Customs Invoice Forms are easy to fill out within minutes, and includes AI technology to automatically generate the correct tariff or HS code for you. You can avoid invoice errors and ensure your shipment is correctly classified every time. The process is easy to follow and completely free! Your customs invoice can be easily sent between carrier, broker and shipper, for seamless communication and processing.

Free Canada Customs Invoice Form

Customs delays are all too common, but knowing how to avoid them will help you make it through customs efficiently. It can be challenging to ship internationally, but our team at Zipments has developed the technology and has the experience to make it easy. With a click of a button, you can clear up your customs problems with ease and be on your way!

-2.png?height=200&name=Brown%20Simple%20Tips%20Shoot%20Blog%20Banner%20(2)-2.png)

-1.jpg?height=200&name=Blue%20Illustrated%20Dots%20Hosting%20Provider%20Presentation%20(9)-1.jpg)