Customs clearance is the most important process in global trade. If you are shipping goods between...

Tips To Speed Up Customs Clearance In The U.S.

Global shipping is a key part of the global economy. Customs clearance, however, can present setbacks to cross-border transactions. Customs regulations vary from country to country and can change frequently, so it's important to understand what you need in order to get the best experience. The united States is a large market for any business, so it is of interest to import into the U.S. quickly and cost-effectively. Customs clearance is an essential part of importing into the United States, and it is one big hurdle to cross. We've got some tips on how to avoid delays in your U.S. shipments and get the best of both worlds: convenience, speed and security.

A shipment that crosses an international border is subject to customs clearance, even if you are shipping goods between U.S. and Canada. Though the two nations share a border, there are still international customs protocols in place. Customs plays a vital role in ensuring that goods are entering and leaving the country safely. However, no matter where you're shipping from, if you plan on importing into the United States, then you will want to understand how the process works and how you can maximize your efficiency.

When Do You Need Customs Clearance?

All shipments entering the United States from another country will require a customs clearance. Customs and Border Protection (CBP) oversees that all shipments are reviewed to ensure safety and admissibility into the country. The amount of time spent at the border, and the cost of customs clearance, will however depend on your shipment and the documentation presented to customs officials.

Customs Clearance Process In The United States

The customs clearance process is quite time consuming, when it comes to dealing with CBP. There is first the process of paperwork verification, where customs officers ask for all required documents and verify that the cargo is admissible. Once documentation is sorted, there also has to be payment of duties, taxes and any other outstanding fees the shipment may incur. Before the shipment can clear customs, the fees have to be paid. Once the duties, taxes and fees are taken care of , then the shipment is cleared and can head to its destination.

There are two types of entries you may be shipping with, informal or formal entries. Shipments with valued under $2500 USD are considered informal, and thus the requirements to clear customs are a bit less than formal entries. For shipments valued over $2500, which are commercial entries, there is a formal entry needed, and formal entry requires specific paperwork be present. Some of the documents you may need to present with a formal entry include:

- Bill of Lading

- Importer ID Number

- Customs Invoice

- HS Code

- Certificate of Origin

- Entry Manifest

- Any Additional Licenses or Permits

Due to regulation, certain goods do require added certification to be able to enter the US, such as hazardous materials or food products. A few agencies you may expect to work with include Food and Drug Administration (FDA), Environmental Protection Agency (EPA) and Department of Transportation (DOT).

How Long Does It Take To Clear Customs?

On average, a smooth customs clearance will take less than 24 hours, and shipments should not be held up at the border for long once there. However, in the case of additional inspections or document issues, it could take days or even weeks, to resolve the problem and clear the goods. If goods are considered high value or hazardous, then you may need to plan ahead for added inspection time.

Duties and Taxes In The U.S.

Even when importing next door from Canada, when goods cross the border into the United States, there is a duty which will need to be paid for the shipment. The type of goods, commercial value, and regulations in place all help determine import fees. Duties vary based on product type and country of origin, which is why classification of goods is important on your paperwork. The HS Code, or Harmonized Tariff Schedule, is what will help determine the duties imposed, and this code should always be on your customs invoice.

Easy and Quick Customs Invoices

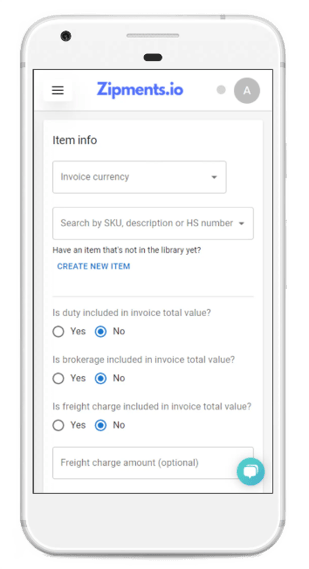

You do not need to spend hours working on your customs invoice and researching the correct tariff for your product. With the Zipments Customs Invoice Forms, you can complete your CBP approved invoice in minutes and ensure accuracy the first time.

Zipments forms are easy to fill out, so that you do not miss any details.

You can transmit the invoices between carrier, broker and importer, for easier communication and visibility in the customs process.

Zipments customs invoices, for both US and Canada, use AI technology to generate tariff codes for you, so that you don't have to waste time researching and risk getting the wrong code.

For the United States, goods incur import fees once they exceed the de minimis value, which is the minimum taxable value for imported goods. As of now, per section 321, the maximum to qualify for duty free entrance is $800 USD. Some restricted goods may also incur fees, regardless of their value, due to the type of goods they are. You can also ship DDU or DDP, which helps determined the distribution of fees and how they are paid.

Delivery Duty Paid: DDP means that duties and taxes have been paid on the shipment, and they are thus included in the shipping price paid, so the recipient does not need to pay added fees.

Delivery Duty Unpaid: DDU means that import duties and taxes are not yet paid, which means that the fees are likely then forwarded to a customs broker to collect and pay customs the amount owed. The final amount is not calculated right away with DDU, because it will vary based on shipment value, tariff and country of origin.

Tips For Faster Customs Clearance In The U.S.

You can speed up the customs clearance process by knowing what to expect and studying the regulations of the country you are importing into. The CBP advises all importers to learn about CBP policies and procedures, to familiarize themselves with any specific entry requirements applicable to their shipment or commodity. Other ways to speed up your customs clearance process when importing into the United States include:

Know Your Shipment

The best way to ensure a smooth customs clearance process, is to know your shipment details, and what is needed to clear it. Having knowledge of your shipment, as well as importation rules will allow you to take advantage of trade agreements which may be in place, and potentially reduce your customs costs if your goods qualify for the benefits.

You should also know the specific documents you need to provide, and ensure that you plan ahead in the case your shipment needs added licenses permits. Importers should be able to provide as much detail as possible about the transaction, such as merchandise description, country of origin, intended use and pricing information.

Be As Specific As Possible

Customs officials will examine documents to make sure goods are not shipped illegally, and that they are allowed to enter the country. Officials will need to manually check and compare contents to the paperwork if there is confusion or suspicion, which will result in delays for you. In order to maximize efficiency, you will need to be specific when describing the contents of your shipment, in order to avoid fines and also save time.

Remember that even minor errors could be interpreted as falsifying documents, so it is important to be as clear as possible in your documentation. This process also applies to dealing with your vendors, as you want to make sure you provide details relevant to the paperwork such as SKU numbers, terms of sale and tariff codes, in order to avoid paperwork errors that can later lead to delays at customs.

Use Correct Incoterms

Buyer and seller responsibilities are often outlined in the incoterms of the paperwork of a shipment. The International Chamber of Commerce (ICC) oversees regulations and laws in cross-border importing and exporting, and thus they update incoterms rules every 10 years. You will always want to keep up to date and make sure you are using the correct terms, because they are important in understanding buyer/seller obligations, freight costs and customs protocols.

For a more detailed look into incoterms, visit: The Importance of Incoterms In International Trade

Get Your Permits and Licenses

You will want to research your commodity and ensure that there are not additional licenses or permits needed for your goods to clear customs. Certain goods such as textile articles or dairy do require a special license or permit for import. Permits and licenses do take time to be issued, so you will need to do your research of licensing requirements ahead of time, and make sure your goods are equipped and ready before reaching customs.

Build Connections

One way to reduce time at the border is to build relationships with customs authorities or other relevant parties in the import and export process. Relationships can build trust and credibility, which can help minimize inspections or time spent at customs. Being cooperative and honest is the first step toward building relationships, especially if you plan on importing often. You can also apply for the Customs-Trade Partnership Against Terrorism (C-TPAT) program, which is a voluntary program that can lead to less inspections and even priority processing.

Carefully Gather Your Documents

Your paperwork is your key to clearing customs quicker, so it will be important to get everything together and accurate. Incorrect or incomplete documents will lead to costly customs delays, so it is important to be as detailed as possible in your paperwork process. Researching the country you are importing to can save you money and time. Since the United States abides by the United-States-Canada-Mexico agreement, then you will need the USMCA Certificate of Origin document, for example. Small details are important in your paperwork process, as missing or incorrect documents can turn into a costly delay for your business.

Streamline Customs Clearance With Zipments

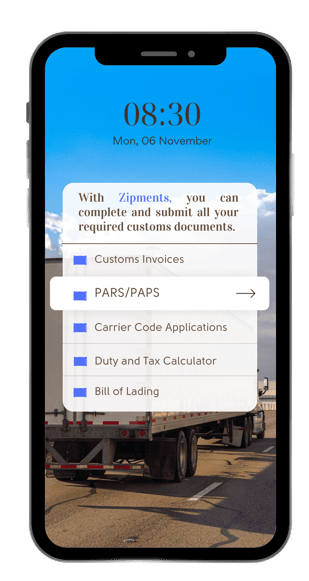

Fortunately, digital documents are now possible, which can ensure a more organized and accurate approach to your customs paperwork. When you use Zipments, you can reduce risk of error and confusion in the customs clearance process. You can create documents such as your customs invoice or Bill of Lading faster, transmit them to the parties involved more easily, and increase efficiency thanks to pre-arrival clearance.

Customs clearance is a process that should not disrupt your business. It can be a complicated and confusing process. However, customs clearance can be faster if you use Zipments, a customs documentation solution that lets you streamline your documentation and communicate with all the parties involved with more ease.

We've combined the latest technology with the traditional customs process and made it easier and faster to clear customs. It's one less thing for you to worry about. It's easy, fast and will save you time and money.

-2.png?height=200&name=Brown%20Simple%20Tips%20Shoot%20Blog%20Banner%20(2)-2.png)

.jpg?height=200&name=White%20Minimalist%20Aesthetic%20Magazine%20Photography%20Portfolio%20Presentation%20169%20(19).jpg)