Customs clearance is the most important process in global trade. If you are shipping goods between...

Unlocking Success: How To Navigate Customs Regulations In International Trade

The seamless exchange of goods and services across borders has become the lifeblood of nations; driving economic growth, fostering innovation, and creating countless opportunities for businesses of any size. At the heart of this process is customs compliance and the intricate web of customs regulations that govern international trade. However, each country has its own unique set of regulations, making it imperative for businesses to understand how these regulations impact their customs clearance. By gaining a clear understanding of these regulations, businesses can unlock the key to simplifying and streamlining the international trade process.

.png?width=1920&height=1080&name=Red%20Blue%20Neon%20Technology%20Video%20(4).png)

Customs compliance refers to the act of following the trade regulations of the countries involved in the export or import process. The regulations in place ensure safe trade and protect the economy of the countries involved. To be compliant means one is comprehending and abiding by the laws, regulations, and protocols established by national governments and multinational entities which regulate global trade. By embracing customs compliance as an integral part of their operations, businesses can build trust and credibility with their international partners, establishing themselves as reliable players in the global marketplace.

However, customs compliance requires a deep understanding of the regulations governing the shipment or importation of goods in each respective country. Different countries all have varying rules, trade restrictions and laws, when it comes to imports and exports; thus it is important to research the regulations relevant to your shipments. However, there are a few basic elements to customs regulations that every business should be familiar with.

Submission and Filing

Most countries have adapted to a digital method for document submission and review, so it is important to research and know the needs for each country you plan on shipping to. Electronic declarations are used to send shipment information in to customs, before goods even arrive at the border.

In the United States and Canada, the ACE and ACI eManifest systems are in place. Shipments need to have a filing through the online portal minimum one hour before arrival at the border. The trade community reports imports and exports, while the government determines admissibility, all through the automated online portals. For Canadian exporters, it is also important to look into any export laws in place. For instance, in Canada you will need a CERS filing to export goods anywhere other than the US, and may face fines and penalties if you do not comply.

To understand how to file your CERS and avoid fines, learn more by reading: The CERS Filing Can Make or Break Your Canadian Export Process: What You Need To Know.

Documentation Requirements

All international shipments will require extensive paperwork, in order to adhere to rules and laws in place. The documentation helps identify the shipment, identify parties involved and any contracts in place, as well as helping customs determine duties and taxes on the shipment. A few of the basic and required pieces of paperwork nearly all shipments will need does include:

- Packing List

- Bill of Lading

- Customs Invoice

- Certificate of Origin

- Applicable Licenses or Certificates (For restricted or controlled goods especially)

Any incomplete or missing documents, as well as errors, can lead to delays at customs, because documentation will need to be corrected, or goods may be sent to further inspection as a result. Generating your customs paperwork will be one of the most important steps in your shipping journey.

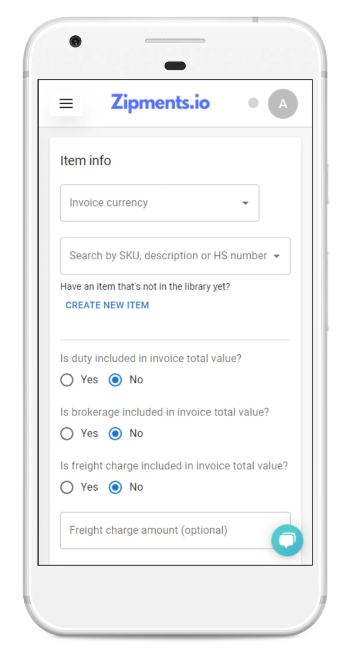

Tired of spending endless hours trying to fill out complex customs invoice forms? Zipments has revolutionized the process with our user-friendly and efficient solution.

Not only will our customs invoice forms save you time, but they are also incredibly easy to fill out. We have simplified the entire process, eliminating confusion and frustration. You can generate a Canada Customs Invoice (CCI) or US Customs Invoice in minutes.

Our advanced AI technology takes the hassle out of determining the correct tariff for your shipments. No more second-guessing or worrying about costly errors. With Zipments, you can trust that the correct tariff will be generated automatically, ensuring compliance and peace of mind.

✔️ Our tariff AI will automatically detect the HS code on your behalf

✔️ You can generate your BOL

✔️ Easily transmit invoices to your carrier or customs broker

Customs Valuation

In order for goods to be compliant and cleared through customs, it is essential to know the value of the goods in question. The process through which goods are assessed for their value are part of customs valuation, and there are usually six basic methods of valuation, which can include transaction value, deductive value and more. Remember that undervaluing items could be viewed as fraud, and this may lead to heftier penalties at customs. Goods value helps determine duties and taxes which may be incurred, thus it is important to declare the proper value otherwise you may face fines or delays.

Duties and Taxes

All goods shipped internationally are subject to tariffs, which are taxes imposed on goods in order to protect domestic economy and help generate revenue for a country. One of the most important components of international trade will be in getting the correct tariff. Tariff rates differ based on the goods involved, and there is a classification process which helps customs apply the appropriate tariff in place.

The Harmonized System (HS) is a standardized system through which goods are classified globally, and can be easily assessed through the tariff or code. Goods must be correctly classified, as the HS code or tariff is what is used to determine the duties or fees a shipment may incur at customs.

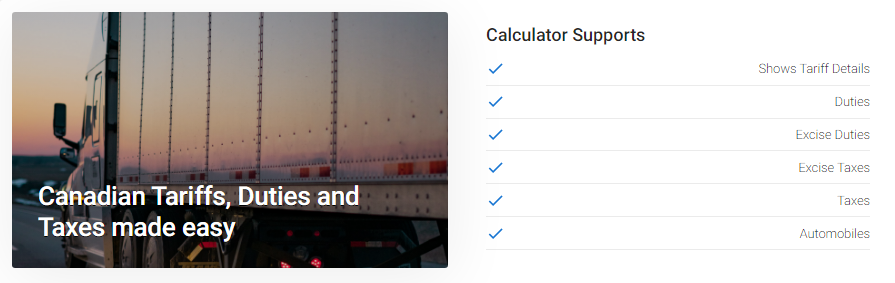

Importing goods into Canada can be a complex process, especially when it comes to understanding and calculating tariff, duty, and taxes. But there's a way to simplify the process.

Zipments user-friendly Tariff Duty and Tax Calculator takes the guesswork out of importing, making it easy for you to determine the exact amount you'll need to pay. No more confusion or surprises at the border

Rules of Origin

The rules of origin help to determine admissibility of goods into a country, calculate duties and taxes, and identify any preferential trade agreements in place. The rules of origin are the laws, regulations and guidelines used by governments to help assess a products country of origin, meaning where it was manufactured, produced or created, and can help answer questions for customs regarding your goods. Some goods are controlled or even prohibited from entering certain countries, which is why the rules of origin are integral in the process.

How To Stay Customs Compliant

In order to ensure ease at customs, it is of utmost importance to keep informed on any current regulations, as they do change with time. Shipping internationally does involve a lot of preparation and forethought, but it is a process which can be simplified by double checking a few easy steps in your preparation.

- Review your valuation to ensure accuracy

- Check tariff classification to ensure it is correct (or use Zipments!)

- Research any restrictions pertaining to your goods ahead of time

- Become proactive in providing documentation to your broker ASAP

- Obtain necessary licenses or permits

- Main records of your paperwork and process in case of audits

- Use expert help to simplify your process

By recognizing the significance of customs compliance and understanding the diverse regulations of different countries, businesses can navigate the complexities of global trade more effectively. With proper planning and preparation, they can ensure a smoother flow of goods and services, minimizing delays and maximizing efficiency.

To ensure a smooth and efficient customs compliance process, it is essential to leverage the right platform. With Zipments, you can take advantage of a comprehensive solution that simplifies your customs paperwork process, and ensures accuracy in classification. By utilizing this streamlined platform, you gain access to real-time clearance status updates and all the necessary documents for your shipment, so you can keep growing your business.

-2.png?height=200&name=Brown%20Simple%20Tips%20Shoot%20Blog%20Banner%20(2)-2.png)

.jpg?height=200&name=Food%20Presentation%20(1).jpg)

-1.jpg?height=200&name=Blue%20Illustrated%20Dots%20Hosting%20Provider%20Presentation%20(9)-1.jpg)