Getting your international shipping right can make all the difference when it comes to getting your...

Navigating Customs Invoices: Key Information You Must Include On Your Invoice

Customs invoices are a vital component of international shipping, acting as a cornerstone document for customs clearance and regulatory compliance. Properly preparing customs invoices is an essential step in ensuring the smooth movement of freight across borders and avoiding delays in the shipping process. In order to prevent issues and delays at customs, it is important to know how to prepare a customs invoice. By following proper invoice guidelines, you can streamline the customs clearance process and enhance the efficiency of your international shipping operations.

.png?width=2240&height=1260&name=Blue%20White%20Modern%20Business%20Blog%20Banner%20(3).png)

Include Correct Information

It is important to ensure that all information on the customs invoice is accurate, and matches the details of the shipment itself. Any discrepancies between the invoice and shipment, will likely lead to delays until the documentation is fixed. It is especially important to ensure accuracy of the description of goods, quantity, value, weight, and country of origin. These details will help determine the duty and tax amount for your shipment.

Use Standard Format

Customs invoices formats do often vary based on the country you are shipping to. For instance, Canada has the Canada Customs Invoice (CCI) format which has to be submitted for clearance, as it contains more information than the standard commercial invoice. Customs is at liberty to reject invoices which do not match the format required. It is imperative to include all necessary details such as the shipper's and consignee's information, invoice number, date of shipment, as well as a detailed description of the goods being shipped.

Include Relevant Harmonized System (HS) Codes

In order for the shipment to be accurately assessed, it is important to assign the appropriate Harmonized System (HS) codes to each item on the customs invoice. HS codes are used to classify goods for customs purposes and determine applicable duties and taxes, which makes them very important for customs clearance. Accurate HS codes help customs authorities assess the correct tariff rates.

Provide An Accurate Value Declaration

All shipments need to include an accurate value declaration, in order to clear customs. You must declare the accurate value of the goods on the customs invoice, including the unit price and total value. Declaring the wrong value may not only lead to delays, but you may also be flagged for the error as it could be deemed as attempting to avoid duties and taxes on your shipment. It is key to be transparent about the pricing to avoid any discrepancies during customs clearance, as any issues could lead to costly delays.

Use Currency Conversion

If your customs invoice is in a currency other than the local currency of the destination country, you must then provide a clear and accurate conversion to the local currency. You should always use official exchange rates to ensure compliance with customs regulations.

Maintain Copies

It is beneficial to keep copies of all customs invoices for your records and provide copies to relevant parties involved in the shipment, such as customs brokers, carriers, and consignees. Keeping record helps ensure transparency and facilitates smooth communication during the customs clearance process.

Simplify Your Customs Invoicing Process with Zipments

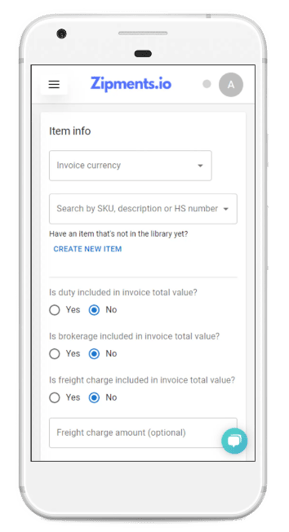

Are you tired of the hassle and stress that comes with creating accurate customs invoices? With Zipments, you can say goodbye to worrying about getting your customs invoice correct.

Zipments is a reliable digital platform that allows you to effortlessly generate error-free and compliant customs invoices. Whether you need a Canada Customs Invoice (CCI) form, or a U.S. customs invoice, by using one platform, you can streamline your invoicing process and focus on what truly matters - your business.

✔️AI Technology Detects Your Tariff Automatically

✔️Seamless Sharing and Transmission

✔️Store Information In Your Personal Data Library

Properly preparing customs invoices is key to ensuring regulatory compliance, avoiding delays, and enhancing the efficiency of your international shipping operations. It is important to remember that attention to detail, proactive planning, and effective communication are essential components of a successful customs clearance process. With the right strategies in place, and a reliable platform, you can streamline your customs clearance and save money.

.jpg?height=200&name=Blue%20Illustrated%20Dots%20Hosting%20Provider%20Presentation%20(11).jpg)

-1.jpg?height=200&name=Food%20Presentation%20(3)-1.jpg)

.png?height=200&name=Grey%20Modern%20Professional%20Business%20Project%20Presentation%20(3).png)