If you're starting a business or growing an existing one, international shipping can be a...

Shipping Goods From The US To Canada? Here's What You Need To Know.

Canada is a large market, and a great opportunity for U.S. e-commerce merchants. As North American neighbor to the US, Canadian consumers have a strong affinity for all things digital, and shopping online is no exception. However, shipping to Canada can be a complex and daunting task. U.S. businesses shipping to Canada need to be aware of the laws and regulations that are in place there, and how to ship most efficiently. To help you better understand the shipping requirements that are expected of businesses shipping into Canada, we’ve put together this handy guide.

-2.png?width=2240&height=1260&name=Brown%20Simple%20Tips%20Shoot%20Blog%20Banner%20(7)-2.png)

Regulated and Prohibited Goods

While the U.S. and Canada are close in proximity, there are still regulations which govern what you can ship to Canada. There are specific restrictions in place, and a list of prohibited goods that you may not be allowed to ship. Restrictions may apply to items such as alcohol, certain foods, collectible coins, and even furs. If you are shipping medicine or drugs into the country, there are also certain rules which have to be followed. Some highly regulated items include:

- Cosmetics or beauty products

- Hazardous materials such as chemicals

- Tobacco or Alcohol

- Cultural artifacts

- Dairy products or eggs

- Liquids

- Copyright Works

- CBD Products

- Pet Food

- Supplements or Vitamins

Now, you can ship items with restrictions or regulated items, but you will need to get the necessary licenses and permits first, which is why researching ahead of time is important. However, certain types of goods are completely prohibited, such as firewood, weapons or ammunition, drugs or narcotics, beekeeping apparatus, counterfeit coins, and live animals. For a more extensive list of the items which are prohibited or restricted, you should always check the CBSA website, in order to keep up with any updates or changes to regulation.

How Does Canada Regulate Imports?

The Canada Border Services Agency (CBSA) is responsible for ensuring that regulation and laws are followed, when it comes to what can cross the border. They assess and determine how each type of good is to be handled, and which documentation or further inspection may be needed. It is up to the CBSA to determine if a shipment is in compliance with regulation, and Canadian laws, thus determining whether a product is safe to enter the country.

Any limits on specific items which can be imported, result from looking at the type of goods that are coming into the country. The Harmonized System or HS Code classification, plays a critical role in helping regulate goods coming in, by grouping them in accordance to their characteristic and type. Every product entering Canada needs to have proper HS Code or tariff classification, in order for customs to be able to know which material the goods are made from and what the goods are. Goods must be clearly labels and accompanied by necessary paperwork, in order to enter the country.

How To Ship To Canada Seamlessly

In order to ensure that you are shipping in the most efficient manner, and that your goods clear customs, you will want to plan ahead and compile all the relevant paperwork and information. You should know your goods well, so that you can provide detailed and accurate product descriptions on your paperwork. You will also need to complete all your customs information on time, and accurately. Be sure to get any licenses or permits ahead of time, and ensure that you check your paperwork over, to avoid mistakes.

Some of the required paperwork for import into Canada includes:

- Bill of Lading

- Canada Customs Invoice

- Manifest

- Certificate of Origin

- Any Needed Permits or Licenses

- Electronic Export Information (EEI) forms

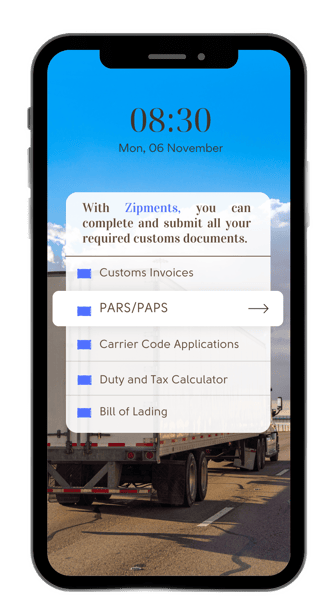

Are you looking for an easy way to gather your customs paperwork? Look no further. Zipments is a fully-integrated technological platform that allows you to compile your customs clearance paperwork with ease. You can now fill out your customs invoice form in minutes, using Zipments. Our software uses AI technology to generate your tariff or HS Code automatically for you, for greater accuracy and speed.

Forget about manually filling out customs paperwork for hours. Zipments makes it easy to create your BOL and customs invoice forms, and share your documents between parties involved. No more delays!

Today, the world of customs is more complicated than ever before. Our technology eliminates the hassle and confusion with its easy-to-use platform. If you are shipping to Canada, then we've got you covered.

Whether you are shipping once or regularly, you will want to make sure that you make the most of technology available to you. Your PARS status allows you to track whether your goods have been cleared to cross, before the driver even reaches the border; making it an easier way to stay on top of any documents you may need to re-address or fix. Though Canada and the United States are neighbors, there are still different regulations between the two countries. A few other ways to ensure a smooth customs clearance, and that your goods can enter Canada include:

- Assign the correct HS Code to your goods

- Use proper labeling (such as special handling or hazardous materials)

- Use a reliable carrier with cross-border capability

- Leave room for delivery, in case of any delay

How Expensive Is Shipping To Canada?

The shipping cost to import goods into Canada depends on a number of different factors, including carrier used and other transport costs, customs broker fees, and then any added fees at customs. If you take care of your transport and shipping costs, it is important to anticipate added taxes or duties calculated at customs. There are numerous ways that CBSA assess fees a shipment may incur; and here the tariff code is essential because it classifies the goods, which is used to determine duties and taxes. Some fees you can expect to be calculated into your total include:

- Goods and Services Tax (GST) which is currently at 5%

- Harmonized Tax (for some provinces, which combines GST and PST)

- Provincial Sales Tax (some provinces)

- Duties

For a detailed breakdown of fees, read: "How To Accurately Estimate Duties and Taxes On Your Canadian Imports".

.png?width=509&height=509&name=Blue%20Modern%20Stocks%20Investment%20Mobile%20App%20Promotion%20Instagram%20Post%20(2).png) If you are importing to Canada and want to get an estimate of what your total fees will be, you can use the Zipments Duty and Tax calculator.

If you are importing to Canada and want to get an estimate of what your total fees will be, you can use the Zipments Duty and Tax calculator.

Our calculator is an easy way to find out your duties and taxes, before you even ship. All you have to do is input the details of the items you are importing; such as value, country of origin and product category, and you will get an accurate estimate.

The Zipments Duty and Tax Calculator Supports:

- Excise Taxes

- Duties

- Excise Duties

- Tariff Details

- Taxes

Who pays for duties and taxes is determined usually ahead of time, but most likely the sender, recipient or other third party will be responsible to pay these amounts. You will need to specify the payment account number when shipping, in order to link to who will be paying the required fee. If any of the parties fails to pay the fees, then the sender may be responsible for the amount in the end.

There are so many advantages to having a presence in Canada—it’s one of the largest export markets in the world, and businesses that succeed there can do well everywhere. As a U.S. business looking to expand into Canada, our team at Zipments is here to help you navigate the customs considerations of importing. Whether you need easy forms, duty and tax estimates, or port information; you can access it with just a few clicks. It's not just about expanding your market—it's also about ensuring that you've got the right tools and expertise to do so successfully.

.jpg?height=200&name=Food%20Presentation%20(1).jpg)

.jpg?height=200&name=Blue%20Illustrated%20Dots%20Hosting%20Provider%20Presentation%20(5).jpg)