The best way to grow your business is to expand into your second market. For businesses of any...

Customs Invoice Requirements For The United States

Shipping international? Let's talk about compliance requirements that can affect your business. United States Customs and Border Protection has strict regulations and rules when it comes to commercial goods, so it’s important to stay on top of your paperwork. Customs invoices are one of the most important documents for any international shipment, as the document is used to facilitate customs clearance and ensure regulations are followed.

Accurate and customs compliant invoices are crucial for all businesses, no matter how small or large. Failure to present an accurate invoice can lead to a number of costly penalties, and lengthy delays. When you are considering importing to the United States, it’s important to understand how to fill out a customs invoice, and avoid missing key details.

.jpg?width=1920&height=1080&name=Food%20Presentation%20(2).jpg)

Customs Invoices In the United States

If you are wondering if you need an invoice for customs for customs clearance in the US, then the simple answer would be most likely yes! Customs invoices are an essential part of the paperwork for international shipping. The invoice is a document used by customs officials to assess goods for any duties or taxes which need to be paid on the shipment, so it acts as both proof of sale and further helps facilitate customs clearance.

The exporter or seller is the one who will prepare the customs invoice and provide the necessary information for the document, avoiding errors or misinformation. The importer on record is also responsible for ensuring their goods meet the requirements to enter the United States. You will want to print out 3 copies of your customs invoice, because in transit things happen, and sometimes customs officers may remove a copy before the shipment moves forward.

Duty Rates and Customs Invoices

The customs invoice is one of the most important pieces of documentation, because it is not only a bill of sale between importer and seller, but it also is the document used to determine fees or duties owed on a shipment. Duty rates are determined based on classification of the products entering the United States, and the fees are to be paid by the importer on record. Usually customs brokers are authorized to pay duties on the behalf of their client, but the fees are usually going to be coming out of the import budget, one way or another.

CBP appraises merchandise based on regulations set out in the US Trade Agreements Act of 1979. The methods used are usually ones which look into the transaction value of the merchandise, which makes the customs invoice information is critical in the customs process, as it contains this information.

HS Codes

An essential component to the customs invoice is the HS Code or Tariff. Products entering the United States are classified using the Harmonized Tariff Schedule of the United States. The classification system groups products into specific categories, helping determine the rate of duty for the product. The classification or number used to classify these goods is referred to as the Harmonized Tariff Schedule.

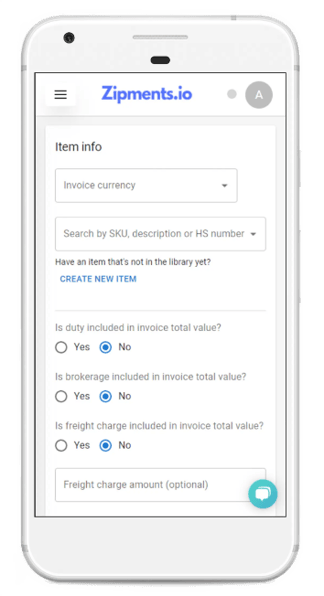

The classification process can be challenging, as it requires research and product information. Any mistakes can lead to penalties, increased duties and issues with customs. However, when using the Zipments customs invoice forms, AI technology will automatically generate HS codes for your shipment, ensuring accuracy and saving you time. The easy to use form template contains all the necessary information and allows you to complete your invoice in minutes. You can get started right now, with one click.

What Does a Customs Invoice Look Like?

There are a number of different pieces of information which are required for a customs invoice to be accepted by the CBP. The document should be completed in the English language, and needs to be signed by the shipper or seller, ensuring that it complies with CBP regulations at the time of creation. It is important to make sure that your invoice describes in sufficient detail, what merchandise is in each package individually, for the shipment. When completing your invoice, there are a few key pieces of information the invoice needs to contain and they must be correct, including:

- Buyer or Importer Information (Address, Name)

- Seller Information (Address, Name)

- Manufacturer’s Name (If it is different from the seller)

- Consignee Information (If it is different from the buyer)

- Detailed Description of the Goods

- Date of the Sale

- Quantity, Weight and Other Applicable Measurements of Goods

- The Price of Goods and Currency Used (Must be converted to USD)

- Terms of Sale

- Additional Costs Such as Freight, Insurance, Packing etc.

- Country of Origin

- US Port of Entry

What Value Do I Put On The Customs Invoice?

When completing your customs invoice, you want to make sure that the value included is the price the buyer in the US paid for the goods, as opposed to the amount they will be sold for. Customs and Border Protection (CBP) assesses duty fees for the shipment based on the cost for the buyer in the US, and it does not include freight or insurance costs. The costs need to be converted into USD currency as well. Other additional costs which should be included or noted on your customs invoice for the declared value can include:

- Packing

- Commissions or Royalties

- Production Costs

- Assists/Assistance Given To Supplier At No Charge

- Other Payments Invoiced Separately, Such As Warranty

What Happens if a Customs Invoice Is Rejected? Who Is Responsible For Any Mistakes On a Customs Invoice?

In the case a customs invoice is rejected, the likely reason would be missing details on the document itself or incorrect information or HS code. Customs will hold up a shipment and not allow it to be released until the issue is sorted.

If there are any errors on an invoice, then usually the importer on record is responsible for correcting these mistakes and presenting them to CBP. The exporter will also face the consequences, as they are preparing the invoice. Consequences can be delayed release of goods at customs or further penalties and fines. It's important to make sure that the customs invoice is completed correctly and complies with regulations, as any errors are going to be costly and time consuming.

Can I Print My Own Customs Invoice?

Can I Print My Own Customs Invoice?

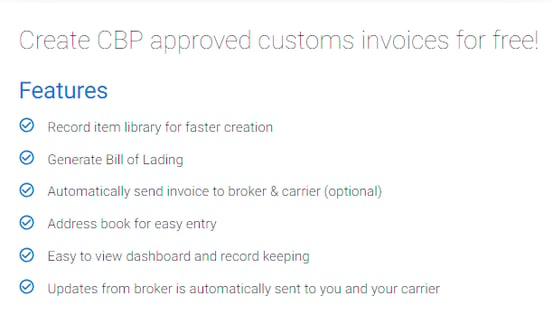

With technology advancing, it is now easy to prepare your own customs invoice within minutes, without needing to pay extra costs. You can print your own invoice, when you have the right technology. You will want to use the Zipments Customs Invoice Form, to create your CBP approved invoice. When using the Zipments forms, you can automatically detect your tariff or HS codes, so you save time in the process.

Ensuring your customs invoices are accurate and complete will help you better protect yourself as a business. When gathering your necessary paperwork, you should rely on a quality customs clearance provider with experience and the technology to help you get the job done. Stay on top of all the customs regulations that vary from country to country, and stay prepared for your next steps, by using the right customs clearance provider for you.

.jpg?height=200&name=Food%20Presentation%20(4).jpg)